Create Lifestyle

Financial

Financial well-being is about more than just income—it’s about creating stability, freedom, and alignment with your priorities. The way we earn, spend, and save reflects what we value and shapes the opportunities available to us.

Core-concepts

Dimension 8

17 minutes 41 seconds: How To Make Financial Wellness Your Reality | Brent Hines | TEDxPleasantGrove

Module 1

Financial Fulfillment

Question

Question

- What actions fulfill my financial dimension?

- What does financial security feel like to me?

- How does money support my overall well-being?

- In what ways can I align my spending with my values?

Login to view.

Module 2

Time & Energy

How much time & energy do I put into my financial dimension?

Login to view.

Reflect on the time you allocate and the effort or energy you invest in each dimension of wellness. Rate yourself on a scale of 1-10 for each dimension, considering the following:

- Time allocation: How much time do you dedicate to activities related this dimension?

- Effort and energy: How much mental, emotional, and physical energy do you invest in enhancing this dimension?

Visualize

Budget

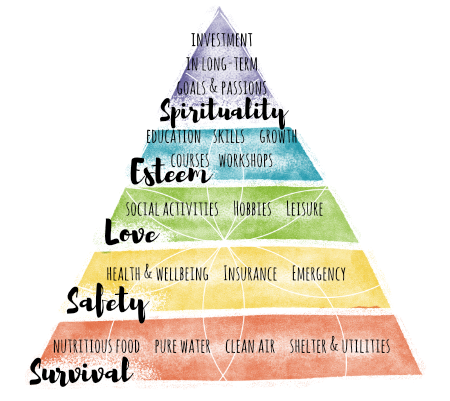

Money is a tool that helps us meet our needs, grow, and create a fulfilling life. Maslow’s Hierarchy of Needs offers a way to view our financial choices beyond just saving and spending—it helps us see where our money supports our survival, security, relationships, self-esteem, and long-term aspirations. By reflecting on our spending through this lens, we can align our financial habits with what truly matters, ensuring that every dollar contributes to a life of stability, purpose, and fulfillment.

1. Physiological Needs

(Basic Survival: Food, Water, Shelter, Health)

- How much of my income currently goes toward essential survival needs (food, housing, utilities, healthcare)?

- Do I feel financially secure in meeting my basic needs each month? If not, what adjustments could help?

- Am I prioritizing high-quality essentials (nutritious food, clean water, safe housing) that support my well-being?

2. Safety & Security

(Stability: Emergency Fund, Insurance, Savings, Future Planning)

- Do I have a financial safety net (savings, emergency fund, or insurance) that makes me feel secure?

- What financial risks or uncertainties concern me the most? How can I prepare for them?

- Am I making choices that support long-term stability (such as debt reduction, retirement planning, or investments)?

3. Love & Belonging

(Community & Relationships: Social Spending, Giving, Experiences)

- How does my spending support my relationships and social well-being?

- Am I investing in experiences that bring me closer to family and friends?

- Do I contribute to causes or communities that are meaningful to me?

4. Esteem

(Personal Growth: Learning, Career, Confidence-Building Investments)

- Do I invest in my personal or professional growth (education, skill-building, coaching, personal development)?

- Are there financial habits that improve my confidence and independence (such as managing money wisely, setting financial boundaries, or negotiating better pay)?

- How does my financial situation affect my self-worth, and how can I create a healthier mindset around money?

5. Self-Actualization

(Purpose & Fulfillment: Dreams, Passions, Higher Goals)

- Does my financial plan support my highest aspirations and long-term vision for life?

- Am I using money to create meaningful experiences, travel, or pursue passions that align with my purpose?

- If I had unlimited financial resources, what would I change about my spending or priorities? How can I start incorporating that now?

Final Reflection:

- Looking at my financial habits, which level of Maslow’s hierarchy am I currently prioritizing the most?

- Are there areas I’ve neglected that need more financial attention?

- What small shifts in my financial choices could help me feel more balanced across all levels?

Actions

Resources

Quotes

Quotes

- “Beware of little expenses; a small leak will sink a great ship.” -Benjamin Franklin

- “Money is a terrible master but an excellent servant.” -P.T. Barnum

Question

Question Quotes

Quotes Read

Read Watch

Watch